Don’t Interrupt Your Compounding

JOURNAL & TOPICS

Journal & Topics Media Group | Serving Chicago’s Great Northwest Suburbs

January 2020

THIS WAY TO WEALTH

by Chris Everett

Let’s take a look at the cost of interrupting the compounding in your investments.

- Borrowing from your 401k is a no-no! So many believe that borrowing from their 401k is borrowing from yourself? Not true.

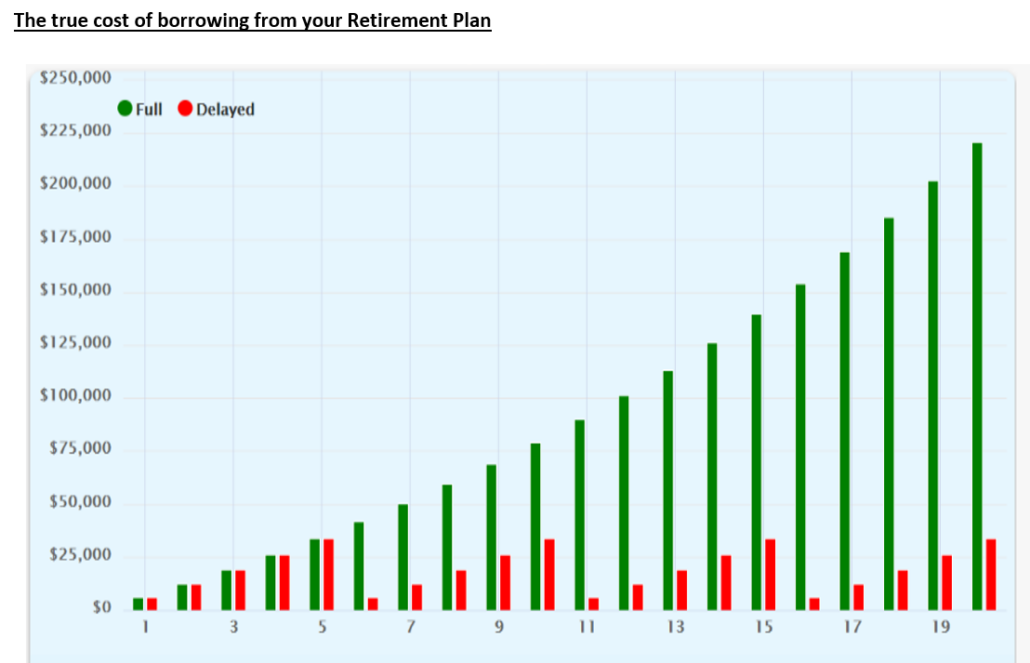

Figure 1 is a chart of Tom’s retirement plan.

He’s been saving $500 per month for the last 20 years. He ends up borrowing from his plan every five years or so. Each time he does, he has the next five years to pay it back plus interest. The interest goes to the lender, not him. The result: he literally starts over every five years.

If we assume Tom makes a 6% rate of return on his account, he would have had $220,714. But, because he continues to interrupt the compounding in the plan by borrowing, after 20 years he only has $33,823.

All that borrowing cost him $186,891! That’s a huge loan cost no one ever explained to him.

If he only put half as much into his plan and didn’t borrow against it, he would have $110,357. It’s not enough, for sure, but it’s 33% better than his previous strategy.

He is better off saving the other $250 outside of his plan in an emergency account. He should also hire a fiduciary financial planner to learn other ways to plug all leaks he’s created.

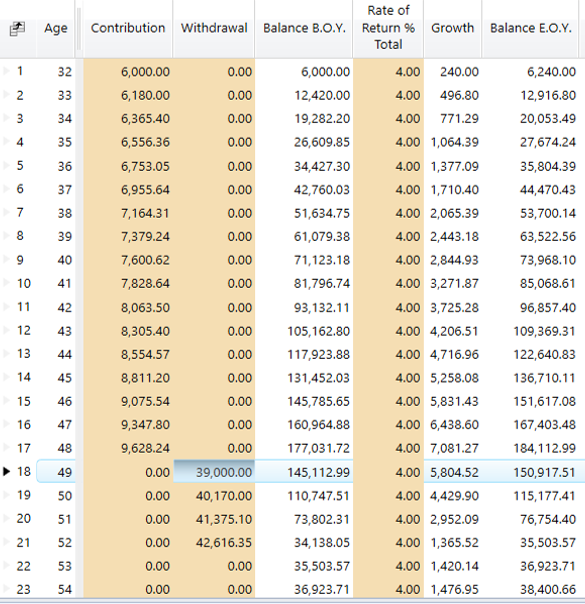

- A 529 Investment Plan (Figure 2) is more costly than you were ever told. You should save for college, just not in a 529 plan. When you contribute to age-based 529 investment plans, the investment mix starts out more aggressive and over time become more conservative. That’s why it’s not uncommon for those plans to average about 4% long term.

If you invest $500 a month in a 529 Investment Plan and agree to increase your contribution each year by 3%, in 18 years, you’d have $184,113. Not bad if you only have one child to educate. They can withdraw $39,000 with a 3% annual increase for four years. Looks like a successful plan, right? And there’s an extra $35,504 left over if your student attends for an extra year – which happens all too often. The plan is interrupted at the very time it was about to really take off and grow. They would have $387,898 at retirement. Of course, they couldn’t do that. #3 below offers a better way.

- Use a Properly Structured Cash Value Life Insurance instead. To make it properly structured, sacrifice death benefit for maximum cash value. Most agents won’t show this to clients because it lowers their commission. But it’s how to get more for your money.

My client Nancy, a 32-year-old new mom in excellent health, will put $500 a month into her cash value policy for only 17 years and will have a death benefit for life. Her policy has a death benefit of $816,585!

When it’s time to pay for college and to protect the compounding in her policy, she will take a policy loan. This places a lien against the cash value but does not interrupt the compounding. She borrows the same amount as the 529 strategy but will have $189,478 of cash still in her policy. After college, she will repay the loan back at $1,500 per month so it’s repaid before she retires. If she needs to stop or restructure the payment she can. At retirement, she will have $24,000 a year in tax-free retirement income with an annual 3% cost of living adjustment. She and her family are much better off with the life insurance strategy.

Plus, she will have a permanent death benefit. After paying for college and taking years of increasing tax-free retirement income, if she lives to age 100, her death benefit is over $1.6m.

By the way, if she needs to access the death benefit during her lifetime for long term care expenses, she can.

Many people find this hard to believe. I think it’s because they are used to outdated designs. If structured properly, all this is possible. Hire a fiduciary who is really on your side to make this work for you, not the insurance agent.

Bottom Line: Stop Interrupting Your Compounding. I have happy clients . . . and I continue to love my job.